Are you considering investing in rental properties? If so, understanding key metrics like Cash-on-Cash Return is essential for evaluating the potential profitability of your investments. In this article, we’ll delve into what Cash-on-Cash Return is, how to calculate it, and explore other ways to assess the profitability of rental properties.

What is Cash-on-Cash Return (CoC)?

Cash-on-Cash Return is a crucial metric used by real estate investors to determine the return on their investment, particularly in income-producing properties. It calculates the annual profit you can expect to earn from your investment property compared to the cash you initially invested.

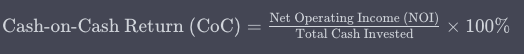

The CoC Formula:

Annual Pre-Tax Cash Flow: This represents the net rental income you expect to receive annually, taking into account rental income, minus all operating expenses like property management fees, property taxes, insurance, maintenance, and mortgage payments.

Total Cash Invested: This includes all the cash you’ve put into the property, such as the down payment, closing costs, and any initial renovations or repairs.

Then plug those numbers into the Cash-on-Cash return formula below:

Interpreting Cash-on-Cash Return:

A positive CoC indicates that your property is generating more cash than you initially invested, representing a profitable investment. A CoC higher than other investment opportunities suggests a potentially better return on investment.

Other Ways to Assess Rental Property Profitability:

While Cash-on-Cash Return is a valuable metric, it’s not the only one to consider:

Cap Rate (Capitalization Rate): Similar to CoC, the cap rate helps you assess a property’s potential return. It focuses on the property’s net operating income (NOI) and its current market value or acquisition cost.

Gross Rent Multiplier (GRM): GRM is calculated by dividing the property’s purchase price by its gross rental income. It’s a quick way to assess investment potential.

Return on Investment (ROI): ROI provides a comprehensive view of your investment’s profitability by factoring in appreciation, cash flow, and equity build-up over time.

Net Operating Income (NOI): NOI is the annual income generated by your property after deducting operating expenses but before mortgage payments and income taxes. It helps evaluate the property’s ability to generate income.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link